James Rosewell writes:

Apps (defined as games, information services, social networking video and web content among others) dominated MWC10 with debate focused on the provision of radio network capacity to support them, the technologies used to create them and the methods for Mobile Network Operators (MNOs) to monetise them. Given the fragmentation in technology and the investment needed from MNOs to provide capacity coupled with a lack of reward for MNOs, we would be forgiven for thinking the App as we know it is not long for this world. However new technologies offering broader platform support, plus smart network investment coupled with new business models, mean the App will evolve and come of age ready for 2011.

Capacity

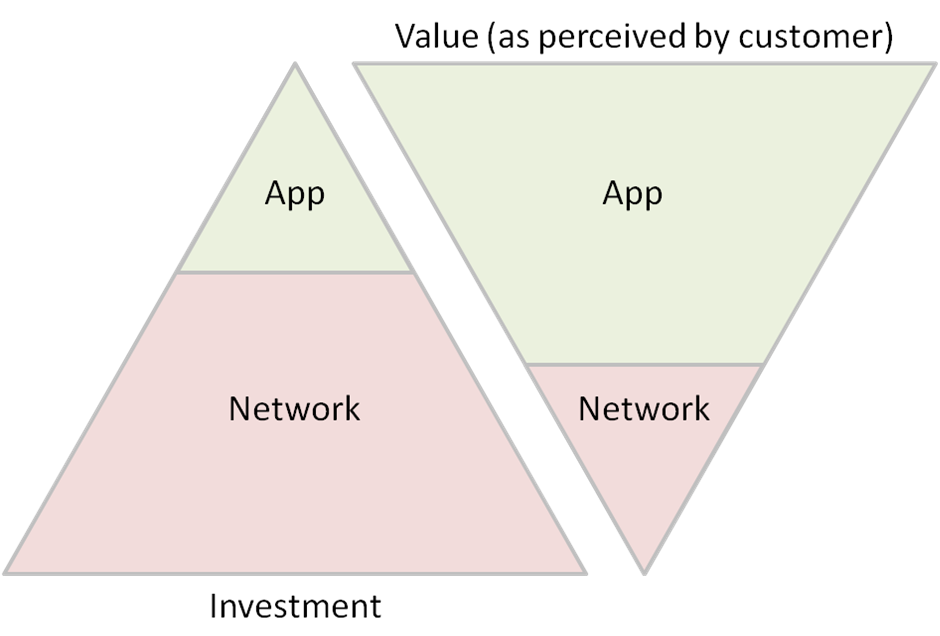

The big problem for MNOs concerns the heavy investment needed to build a mobile data network with sufficient capacity to support data-hungry Apps without a proportional reward from the value provided to the customer. This is illustrated by the diagram below.

According to Gartner, 99.4% of all application downloads in 2009 were from the Apple Store. Therefore it’s no surprise Apple is often cited as an example of a company that's benefited from MNO investment in data network technology without having to pay for it. This is a slightly simplistic argument as MNOs who support Apple devices should have factored this issue into the commercial agreement they reached with Apple. MNOs will often insist on higher value data bundles when iPhones are sold on contract.

With an increasing number of feature phones offering an App friendly platform, the need for data bundles to support them will increase and the price of data bundles will need to fall to drive mass adoption of these phones. The MNO ultimately controls pricing and needs to balance investment with new revenue streams. Fortunately there are many solutions available.

Long Term Evolution (LTE) provides an opportunity to increase radio access network capacity by ten times. Spectrum licences may be needed and new radio technology required for both base stations and handsets. Investment in mobile cell sites will also increase capacity. However neither solution is cheap or quick.

The inclusion of WiFi support on smart phones offers the potential to shift data demand on to fixed broadband providers when used in the home. Savvy users will understand they can enable WiFi on the handset to gain more value from a capped data bundle and very often a faster experience. Smart operators can deploy Femtocell technology to high bandwidth customers further reducing the demand on their radio access networks. Smart applications can be developed that utilise the radio network during quiet periods. For example; pushing video to the handset and storing it ready for playback at a later time.

Technology within the data network can be deployed to reduce the burden further. Mobile transcoders in the network can be used to transform video in real time for a specific handset and network environment. For example; if the handset has a screen 200 pixels wide, is connected via Edge/2.5G video and is accessing video content 640 pixels wide, the video will be reduced in size to 200 pixels and a high compression ratio used to optimise the user experience for Edge/2.5G. As video is expected to form over 50% of data requirements in the future, such solutions buy breathing time for radio network investment. Video isn’t the only data hungry content; basic web pages often contain many features not supported by the mobile handset in addition to redundant data due to poor technical design. Transcoders remove unsupported content, unnecessary data and use compression to reduce the data consumed by a web page displayed on the mobile device.

Mobile Broadband growth is an equally important factor in network capacity. Users are unlikely to receive the same experience when accessing content over Mobile and Fixed Broadband connections in the future. MNOs will alter streamed video and other high bandwidth content to optimise it for the mobile network. Expect to see a two-tier Mobile Broadband experience based on end user pricing.

Content & Standards

Wireless Application Protocol (WAP) version 1.0 was released in April 1998 and described a complete software solution for mobile internet access. Nokia released the 7110, containing the first WAP micro browser, to Western markets in October 1999. Despite all the hype surrounding WAP, for several years after its launch it failed primarily due to a lack of content & services and confused consumer pricing.

On the other side of the world in Japan, i-mode was launched by NTT DoCoMo on 22 February 1999. By 30 June 2006, i-mode had 46.8 million customers in Japan alone. i-mode was successful because content relevant to users was made available to customers. NTT DoCoMo had to invest in content creation by incentivising existing providers & developers and charging consumers a small fee for premium content. A very similar model was repeated by Apple and their now well-known 70/30 revenue split between Developer and Apple.

The growth of the mobile internet in Western countries has been driven in part by the Apple iPhone enabling existing web content to be displayed effectively on the small screen of the mobile and by providing an incentive for software developers to produce Apps for the iPhone. Whilst the iPhone is the poster boy of the mobile internet growth, sensible data pricing from MNOs coupled with easily accessible content via non Apple handsets has also played its part.

Fragmentation, or the “Splinternet”, is now one of the biggest challenges facing content providers and MNOs. Dr Hugh Bradlow, CTO at Telstra, suggested during his keynote speech at MWC10 that 1000 platforms now need to be considered when producing an application that will be available to all mobile devices. Unless Nokia, Samsung, LG, Motorola, HTC and many others roll over and let Apple own the handset market, a solution is needed.

The GSMA, handset manufacturers and MNOs have decided to band together behind the Wholesale Application Community (WAC) initiative. Importantly the Joint Innovation Labs (JIL) project is part of the WAC group and is likely to form the basis of many future standards. As Vodafone, Vodafone partner companies and Softbank are all member of JIL, the significance of its inclusion should not be underestimated. If all goes to plan in 12 months the industry will have defined a common standard for the creation of mobile Apps. However given Apple’s lack of involvement, historic poor cooperation within the industry and conflicting commercial motives, no-one will bet on WAC providing the entire answer.

I envisage two complementing technology solutions will emerge during 2010:

1. Web technologies will evolve with a mobile variant of HTML5 enabling content providers to produce lightweight highly interactive applications predominantly for social networking and information services. Access to the handset location, Near Field Communication (NFC) services, handset data storage, video and high end graphics will all be provided via the browser.

2. Where an application demands greater performance, predominantly for games, the operating system will provide the answer.

Browser-based applications will cater for the lowest common denominator of handset at the expense of exploiting features of high end devices. However web based applications will be cheap and quick to create and will be supported on the vast majority of handsets and mobile networks. Browser manufacturers will start to become more prominent, offering consistent support and familiar user interfaces. Importantly, web page processing will be split between the mobile device and backend servers within the MNO or Cloud. Skyfire entered the mobile browser market in 2008 targeting smart phones by providing this client server model. Transcoder manufacturer Novarra announced its OneWeb solution for MNOs to white label at MWC10. Expect to see many more over the next 12 months.

Operating system applications will be more complex and time consuming to create but will provide the best user experience. Games will dominate and operating system manufacturers will be battling for mobile gamers providing platforms targeting their needs. Microsoft’s announcement of Windows Phone (Series 7) contained significant focus on the inclusion of Xbox. Samsung demonstrated multi-user games on its Bada platform. It won’t be long before Sony Ericsson provides more details concerning its PlayStation Portable mobile strategy.

Established content and service providers will need to consider the mobile. Facebook is currently leading this thinking by providing four different versions of its service for the mobile phone. An ultra low bandwidth version is provided for MNOs who wish to provide Facebook for free as an incentive for customers to purchase handsets. Separate mid range versions are provided for touchscreen and standard user interfaces optimised for each input method. Finally native applications are provided for iPhone and a few other platforms. Content providers urgently need a defined strategy for the provision of their content to the small screen and it’s not going to be a one size fits all solution.

Transcoders are implemented by MNOs to optimise scarce resources but the content provider pays a heavy price in the form of distorted content and in many cases lost advertising revenue. Content providers will need to bypass transcoders by providing content optimised for the mobile device. Transcoder vendors will need to act responsibly enabling content providers to control the mobile experience. A voluntary code of conduct drafted by Luca Passani of WURFL has gained support from many manufacturers of transcoding technology who recognise future revenues will come from content providers in addition to MNOs.

Apps & the MNO Business Model

Ultimately MNOs need a compelling business case to continue to invest in network infrastructure. Without revenue from application stores the only methods available to MNOs to justify investment will be increased data pricing and lower handset subsidies. With customers perceiving the value of their mobile in the application this is an unhealthy model for the entire industry because consumers' data and handset prices will remain higher than they otherwise need to be if the MNO could support network investment through a share of application revenue. It is therefore in the long term interest of application stores to ensure MNOs receive revenue from the application store.

The Apple App Store and Google Android Marketplace charge customers via a pre registered credit or debit card. These methods are expensive in terms of payment processing charges, and customers need to keep their card details up to date. MNOs have a powerful tool to compete with such payment methods. Their established prepay and post pay billing systems offer the opportunity to provide lower cost payment solutions for low value items such as Apps. Customer Relationship Management (CRM) systems provide a wealth of information to promote applications and manage customer queries. However UK MNOs currently use the Payforit system to charge for purchases of ringtones and music among other downloadable content. The high margins associated with this service will need to change if deployed to the mass market. Given the low risks involved in charging application purchases to the mobile account in the same way as voice and data, every MNO and Application Store will be determining how to exploit this potential during 2010.

Vodafone have started their own application store for handsets on their network under the Vodafone 360 brand. Revenue is split 70/30 with the developer; applications are created using JIL standards based on existing web technologies. With only 17 handsets supporting 360 and a small number of applications available for the platform it’s still very early. However Vodafone’s strong brand and massive customer base may prove the MNO application store will be viable.

A less risky and complementary approach for MNOs will be to operate a “shopping mall” of application stores. Rather than promoting a single store they could make many available. Application store owners will be charged a rent and/or percentage of sales. The MNO may provide shared services where appropriate such as payment processing, white label hosting, advertising, customer care and marketing. Such an approach will encourage the creation of niche application stores for specific types of application rather than the "department store" model we have today. Perhaps we could see application stores specialising in the provision of navigation software or skiing services.

The majority of applications will be provided free to the customer, either providing mCommerce services for the purchase of physical goods or being funded via advertising. Given the highly personal nature of the mobile, the value of advertising is many times greater than the traditional web method. Smart MNOs will work with advertising networks using their deep insight into the customer to provide the most relevant adverts. After all, the small screen of the mobile will not enable the sheer volume of adverts we see on most desktop web sites today.

The web design and IT professional services companies will all benefit from the rise of the application store with more and more content providers requiring the specialist skills to create them. Companies providing mobile specific content management systems such as Volantis, or mobile development skills such as YOC Group, have rosy futures.

Summary

MNOs need to continue to invest in network capacity. If they don't, they'll lose customer confidence - and the first customers to move will be the high-value data-hungry ones potentially threatening the MNOs future viability. Application stores will need to win over developers to create applications for their platforms, and common standards are going to be essential to drive growth. Business models for MNOs exist and it is in every party's interest for MNOs to receive a percentage of application store revenues.

In this article I've only touched on some of the complex issues the industry faces. The Fonecast will continue to provide opinion and update via the podcast and future articles.

I'm certain the application store dominated by Apple and platform-specific standards is dead. The technologies and business models that emerge during 2010 will be with us for a long time.

We'd like to thank the following companies for spending time with us during MWC10 and providing their insight into the future of the mobile application.

On Kalich at Flash Networks

Randy Cavaiani, Roger Decker and Dr Thomas Kelz at Novarra

Oscar Guterres Isiegas at Vodafone

Martin Jones and David Roberts at Volantis

Luca Passani at WURFL

Christian Louca at YOC Group